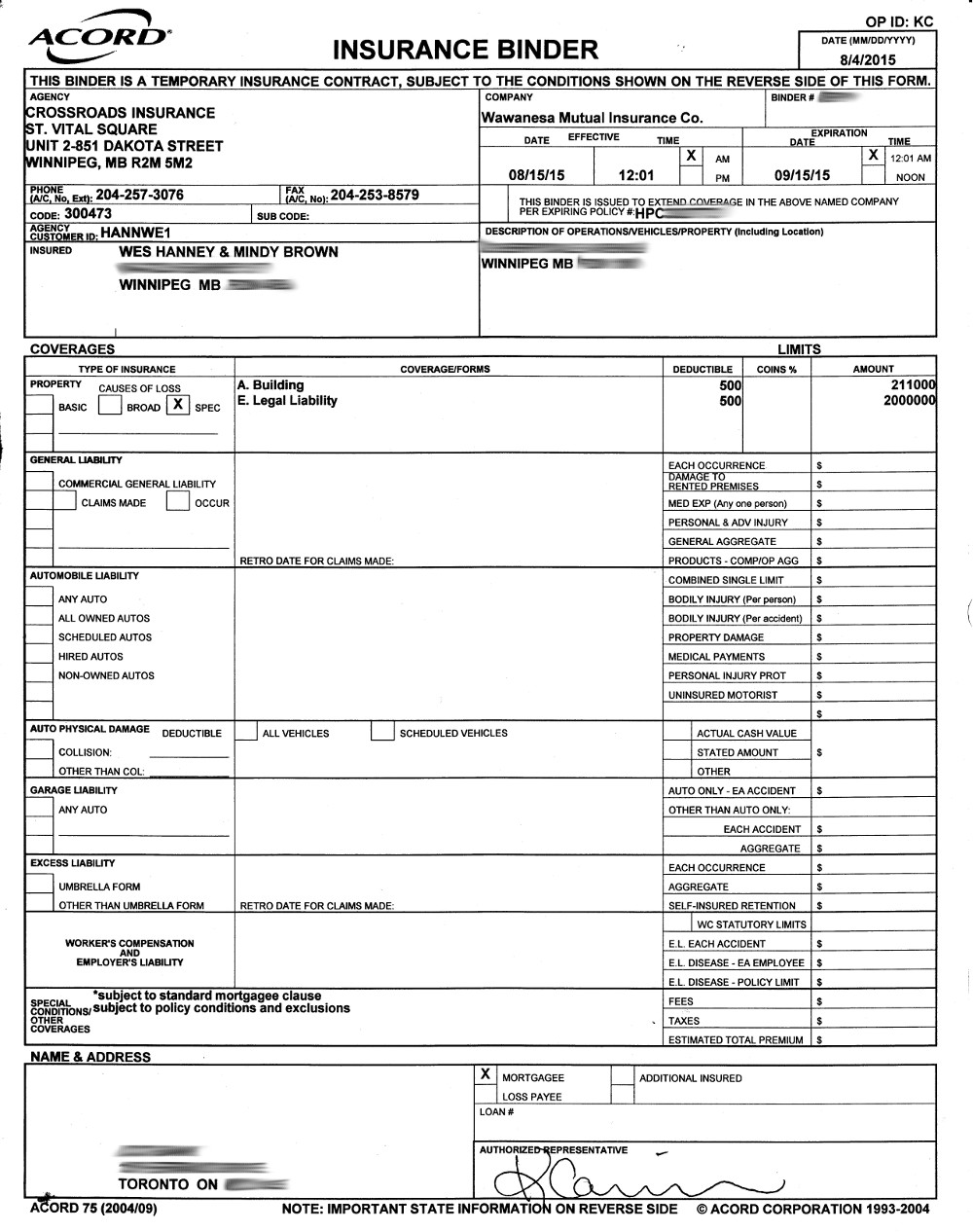

In addition, it is known as a certificate of insurance, a title binder, an insurance policy binder, an insurance card, and a temporary binder. It also identifies coverage limits, charges, deductibles, terms, and conditions. It will serve as proof of that.Īn insurance binder will specify everything, all the protection you have while you anticipate the latest policy. This is where the insurance binder comes in. However, the procedure is yet to be released, and the owner requires proof that it is secured. For example, your business has just bought a motor truck, and you’ve protected the vehicle under the most recent business auto policy. It’s not like the usual binder's name, but just a few documents help identify your contract's legalities.Īn insurance binder is commonly issued when a policymaker requires proof of your insurance coverage. This is usually till a new customary statement is delivered. If you are interested, keep reading for a detailed insight into everything you need to know about insurance binders.Īn insurance binder is a transcribed lawful contract between you and the insurance company, which helps provide evidence or proof for a specified time (which will last only 30–90 days) and will not keep you covered when it expires. So, when you think about it, it’s to help you out in a bind. Also, it helps provide evidence of insurance coverage when purchasing a new car with an auto loan.

It will enable you to drive your car legally before your policy gets issued. This article will discuss one of the most frequently asked questions, “What is an insurance binder for a car?” To keep it brief, short-term evidence of insurance allows you to deliver the proof of reporting required by the law.

0 kommentar(er)

0 kommentar(er)